Business Insurance in and around Snellville

Looking for small business insurance coverage?

This small business insurance is not risky

State Farm Understands Small Businesses.

Preparation is key for when a catastrophe happens on your business's property like an employee getting injured.

Looking for small business insurance coverage?

This small business insurance is not risky

Insurance Designed For Small Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Charisse Hunter is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Charisse Hunter can help you file your claim. Keep your business protected and growing strong with State Farm!

Curious to investigate the specific options that may be right for you and your small business? Simply get in touch with State Farm agent Charisse Hunter today!

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

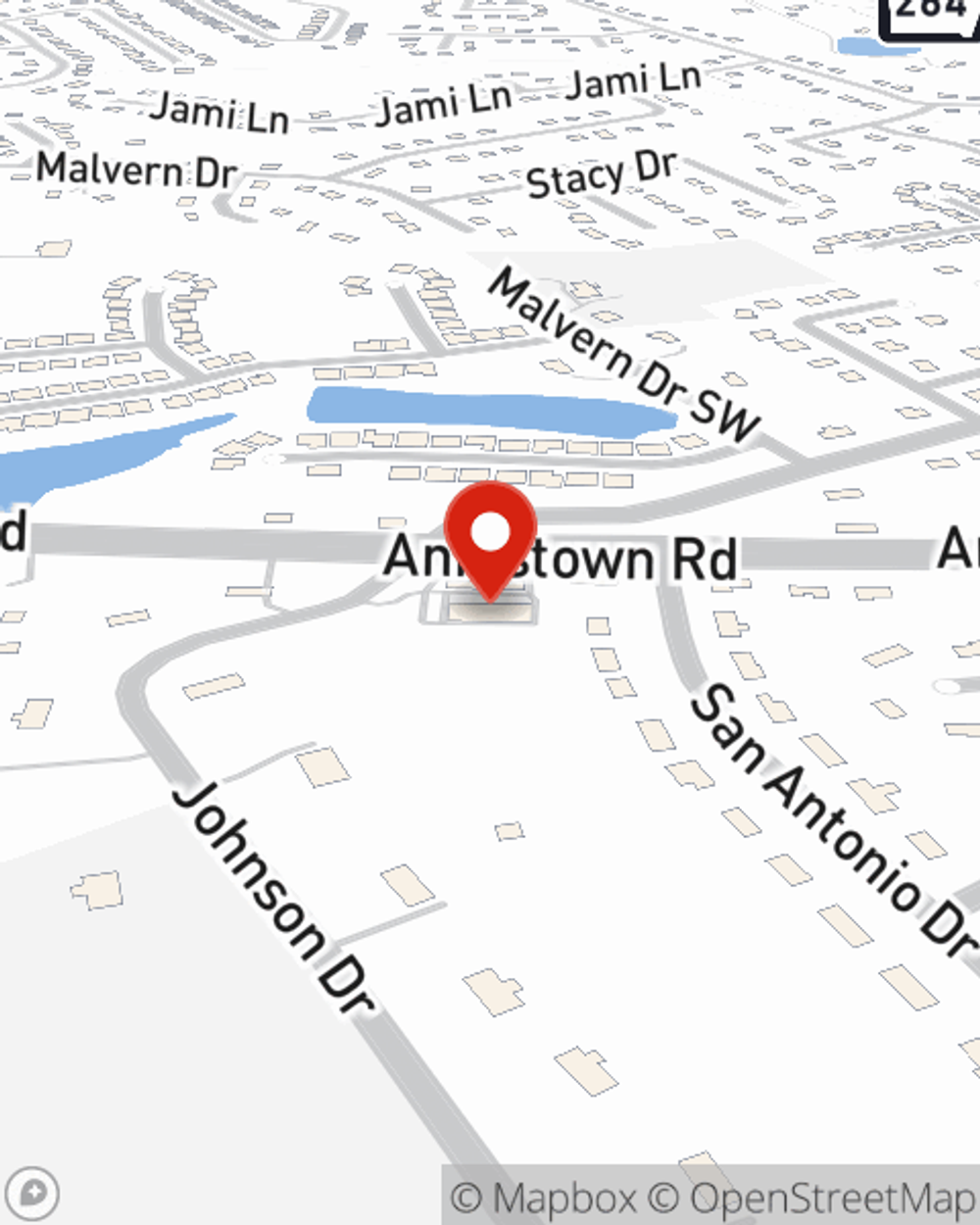

Charisse Hunter

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.